When it comes to car insurance, accuracy in documentation is more than just a formality—it can determine whether an insurance claim is successful or denied. For any vehicle owner, ensuring that the details on insurance documents align with the V5 registration and purchase invoice is essential. Even small discrepancies can create significant challenges, potentially leading to delayed claims, disputes, or outright rejections. Here’s why getting these documents to match is critical for a smooth claims process.

1. Verifying Ownership and Legitimacy

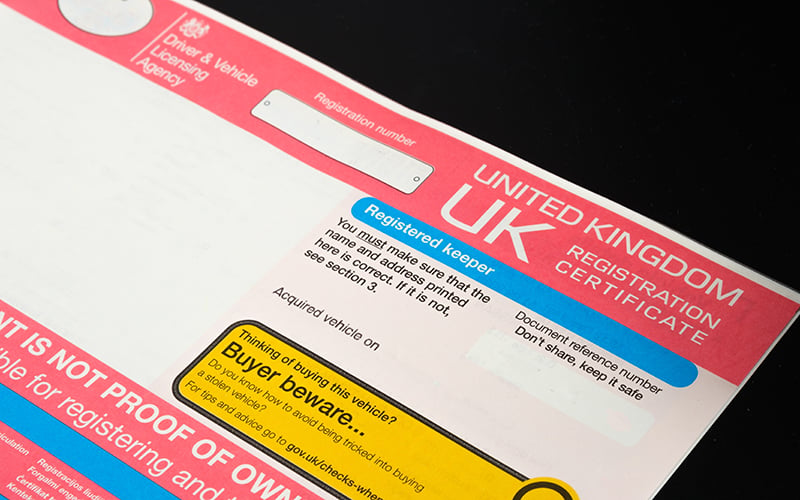

The V5 registration document, also known as the vehicle logbook, is the official proof of ownership for a car in the UK. It records key information such as the vehicle identification number (VIN), make, model, and registered keeper’s details. Insurance companies rely on this information to validate that the person making the claim is indeed the legitimate owner. If the details on the V5 don’t match the insurance documents, insurers may question the legitimacy of the claim, viewing it as potentially fraudulent.

2. Establishing Accurate Value

An accurate purchase invoice provides a record of the car’s value at the time of purchase, which helps determine the payout amount in case of a total loss claim. If there’s a mismatch between the purchase invoice and insurance policy, insurers may challenge the valuation, leading to disputes over the settlement amount. Ensuring these documents align helps confirm the car’s true value and supports a fair claim outcome.

3. Speeding Up Claims Processing

Claims involving inconsistent or mismatched documents often result in delays. Insurers need to verify details across multiple sources, and any discrepancies create more steps in the investigation process. For instance, if the car’s make or model is listed incorrectly, insurers may need to perform additional checks to confirm the vehicle’s identity. Matching documents streamline this process, enabling insurers to process the claim faster.

4. Reducing the Risk of Claim Denials

Insurance companies have strict requirements around accurate information, and failure to meet these can result in claim denial. Mismatches between insurance documents, the V5, and the purchase invoice could signal inaccuracies that violate policy terms. For example, a vehicle incorrectly described on the insurance documents due to mismatched information could be classified as misrepresentation, providing grounds for an insurer to deny the claim entirely.

5. Avoiding Legal Complications

In the event of a serious accident or theft, claims with inconsistent documentation can lead to more than just financial delays—they can also lead to legal complications. Insurers may consider discrepancies as grounds for an investigation, especially if it appears information was intentionally misrepresented. This can lead to more scrutiny, potentially resulting in legal consequences for the policyholder.

How to Ensure Consistency Across Documents

1. Double-Check Details: When purchasing a car, confirm that the V5 registration and purchase invoice details match precisely, and cross-reference these with the insurance policy when setting it up.

2. Update Changes Promptly: If any details change—such as the registered address—update all relevant documents immediately to prevent mismatches.

3. Work with Reputable Dealers and Insurers: Ensure you’re dealing with licensed dealers and insurance companies that can provide guidance on keeping documents aligned.

Final Thoughts

Having matching information across the V5 registration, purchase invoice, and insurance documents is crucial for any vehicle owner. It’s more than just an administrative detail; it’s a foundational aspect of ensuring smooth, successful insurance claims. By verifying that all documents align, car owners can protect themselves from unnecessary delays, disputes, and the risk of denied claims